Edge: Failure or Masterstroke?

By Michael Feit | Feit Consulting

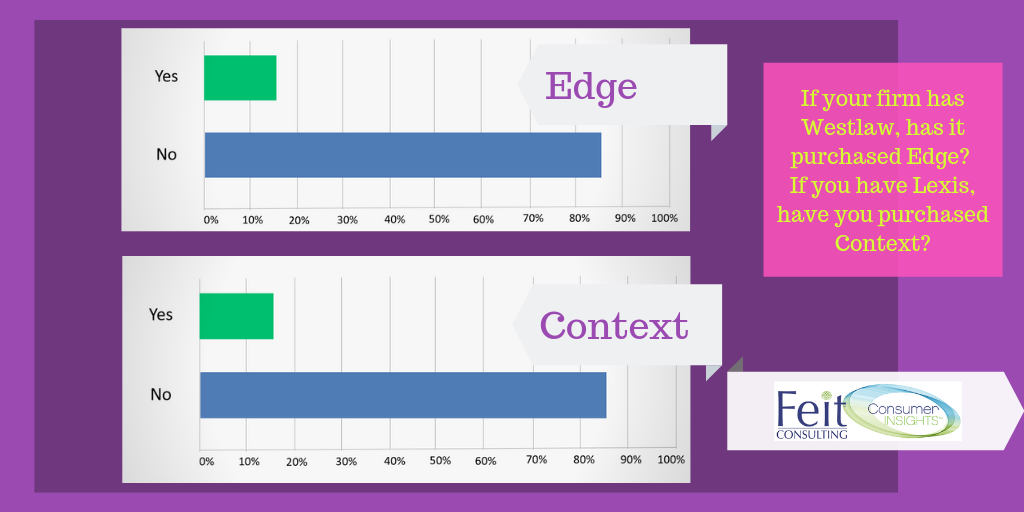

Our recent mini survey about Westlaw Edge and Lexis Context results are in, and it is interesting to compare the data to our forecast for Edge pricing. In our latest book, Optimizing Legal Information Pricing, we forecasted that roughly 20% of the market would purchase Edge within a year, at nearly 10% increases.

With almost a year under its belt, it appears that Edge adoption will be very close to our forecast. With 15% of Westlaw firms having already adopted, we think it is reasonable to expect that in the next 5 months Westlaw Edge will penetrate another 5% of the market.

The average Edge percentage price increase is slightly lower than the double-digit year-one increases we expected, coming in at 9%. Firms that have purchased the product are happy with it, but for the most part, they do not feel that Edge is a game-changer in the way that WestlawNext was.

So, has Edge been a failure or a masterstroke?

To understand the impact Edge sales have had on Westlaw revenue, we looked at the large law firm market segment (defined as firms with over 100 attorneys). We made some general assumptions about that population and for illustrative purposes, using a hypothetical average spend per attorney to come up with potential revenue impact for this segment. Please note this hypothetical does not match our actual price guidance for Westlaw. (You can find that guidance in our Optimizing Legal Information Pricing book here). Below are our assumptions:

- 400 firms in the over 100 attorney segment

- 80% of those firms have Westlaw

- 320 firms have Westlaw

- Average firm size is 250 attorneys

- 80,000 attorneys total large law population with Westlaw

- Hypothetical average spend per attorney for Westlaw in the market $175 per attorney per month

- Hypothetical revenue to Westlaw for over 100 attorney law firm segment: $168 million

Our survey indicated that roughly 15% of the market has purchased Edge, which translates to 12,000 attorneys with the product. If their cost increased 9%, Westlaw’s annual revenue grew roughly $2.2 million annually, or roughly only a 1.4% increase. If this 1.4% increase was the entire story, you’d probably call Edge a failure.

However, to really understand how well Westlaw has actually performed with Edge you need to consider who the real purchasers likely are. In our Optimizing book, we note that roughly 15% of the market is over-paying for Westlaw, by 150% or more. Although we have no way to correlate who each of those firms are, it is very likely that they are most of the early adopters of Edge. These firms tend to be early-adopters of all products and have less price resistance than the market in general.

If you assume that most of the early adopters of Edge have a spend per attorney that is vastly (>150%) above the market, Westlaw’s incremental revenue grows to $6.8 million per year. This represents a 4% increase alone, just from Edge. If that is the case, Edge would be deemed a moderate success.

Beyond this, and likely the greatest impact to Westlaw is the ability to leverage Edge to lock-in and extend a majority of their highest-paying customers. Every Westlaw Edge discussion that is not a renewal (about 2/3rds) is a reason to drop into the firm and extend the agreement for another 3-5-year period, securing a very significant and otherwise vulnerable revenue stream.

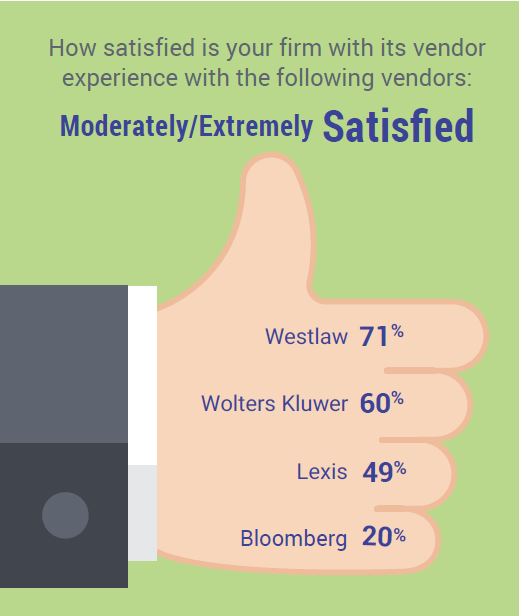

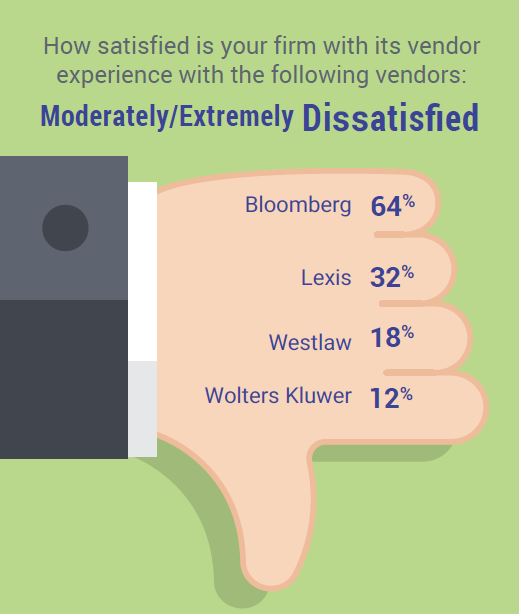

In conclusion, although Westlaw Edge may seem to have had an unspectacular first year, the dollar value increase combined with the ability to extend existing contracts has bought valuable time for Westlaw to hold off potential threats from Lexis or Bloomberg – making Edge a masterstroke.