By Michael Feit | Sole Provider , Surveys

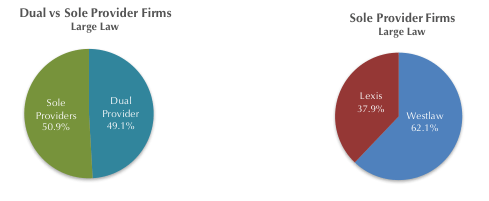

For the first time since the early 1990’s, retaining just Lexis or Westlaw has become the norm. Today, nearly 51% of large law firms have opted to retain only one vendor. There are roughly 400 law firms with over 100 attorneys in the US. Within the last year, Feit Consulting collected data on 389 of these firms. The majority, 51% (198), now only have one vendor. 75 large law firms have eliminated Westlaw, and 123 eliminated Lexis. As contracts are negotiated continuously, there is expected minor fluctuations in both directions. *Data Source: 2016 Feit Consulting Research.

By Michael Feit | Sole Provider , Surveys

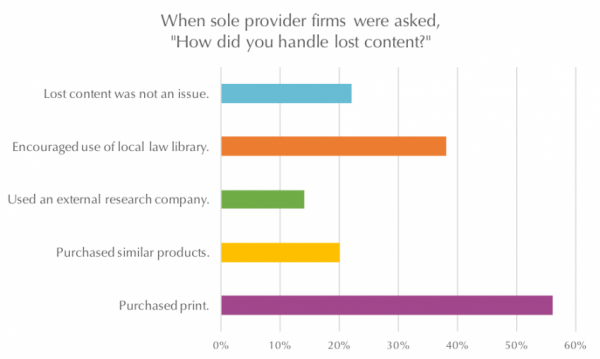

In Feit Consulting’s Sole Provider Experience Survey, 50 firms responded to the question, “How did you handle lost content?” Surprisingly, only 56% of firms needed to purchase print, and 22% said lost content was not an issue.

Selected comments from the survey results:

“Actually kept necessary print. It is getting harder to encourage use of local law library, because they are moving content online also, if they don’t get licensing for visiting researchers then we don’t have access.”

“Also utilize colleagues who can provide assistance if necessary. It’s reciprocal.”

“We have a membership with the county law library, which allows us to access some Lexis content.”

“We heavily evaluated content across providers to make sure that in our practice areas we did not create content gaps. We surveyed attorneys in practice groups to aid us in making these decisions. We did compare-and-contrasts between vendors, and we had focus groups to address individual concerns of power users.”

“We spend more on our outside document company than we did before.”

To purchase the full survey results, contact Feit.

By Michael Feit | Budgeting , Sole Provider

Imagine if Lexis and Westlaw were new products today, offering your firm the same subscription price you already have. Would you really purchase both? Most would argue that these products are far too close in total content to need both. Yet, many firms still have both of these vendors. This duopoly paradigm has been in place since the early ’90s, and has become the norm in law firms.

Historically, nearly all firms retained both Lexis and Westlaw because the majority of costs could be passed through to clients. The recession forever changed the dynamics of the online legal information market for both vendors and firms. Firms started to see their sophisticated corporate clients closely scrutinizing costs and refusing to pay for online legal research. Now that recovery rates have greatly diminished, firms are being forced to evaluate their need to retain both vendors.

By Michael Feit | Sole Provider , Surveys , White Papers

Several tools were utilized in obtaining data for our Sole Provider Playbook.

To capture the full-market view of the sole-provider trend, Feit Consulting collected and analyzed data from midsize and large law firms, with greater emphasis on large law. This report has been a collaborative effort, with subscribers’ concerns steering our research.

Data was collected through the following methods: