Throwback Thursday

By Michael Feit | Vendors , White Papers

Flashback to 1994 when the “customer is always right”. The online legal information market was so much fun to be a part of during the mid-nineties, for both vendors and law firms. Law firms loved their vendors. In the go-go 90’s, everything was great. The market was super-charged everywhere.

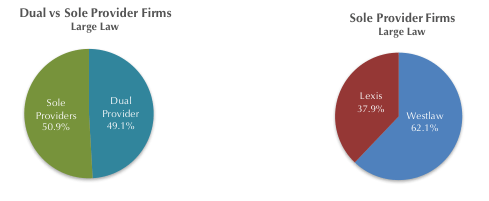

By 1994, 95% of large law firms had both Lexis and Westlaw. Usage and revenue was increasing 20-75% annually. Firms enjoyed the “customer is always right” philosophy that both vendors embraced. Customer feedback was respected and encouraged. With costs being passed through to firms’ clients, it was a period of mutual admiration.

The competition between Westlaw and Lexis was fierce on all fronts. Both products were continually and rapidly enhancing with tremendous ongoing innovation. The products became more complete, with deeper and more archival content sets.

Healthy competition spurred each vendor to strive to match and surpass the other in content functionality. Lexis was favored for news and information, while Westlaw was favored for litigation. One vendor would announce a new feature, only to be matched and outdone by the other.

As growth accelerated and prices increased, the vendors worked even harder to ensure costs would not become a concern to law firms. Vendors created very successful programs to instruct firms on how best to develop and maintain strong online cost recovery.

It was a true win-win relationship for the vendors, law firms, and the lawyers.

Feit Consulting’s white paper, Westlaw & Lexis: Path to Commoditization tracks the progression of these two vendors and provides a future outlook. Learn more here.