Oversaturated Market Causes Unfavorable Contracts for Loyal Customers

By Michael Feit | Contract Negotiations , Pricing

If you love Nordstrom (or Target, Starbucks, etc), being a loyal customer has lots of benefits.

Retailing in the 21st century is oversaturated, so many similar brands create a bidding war for consumers.

And loyal consumers win the most: discounts, perks, events, you name it–they all await the customer willing to channel more spending toward one brand.

That mentality is so ingrained, it’s easy to think it’s true with your legal information vendors. Sadly, it’s the opposite.

The key difference, of course, is that legal information isn’t really a marketplace at all, and the benefits of open competition don’t apply.

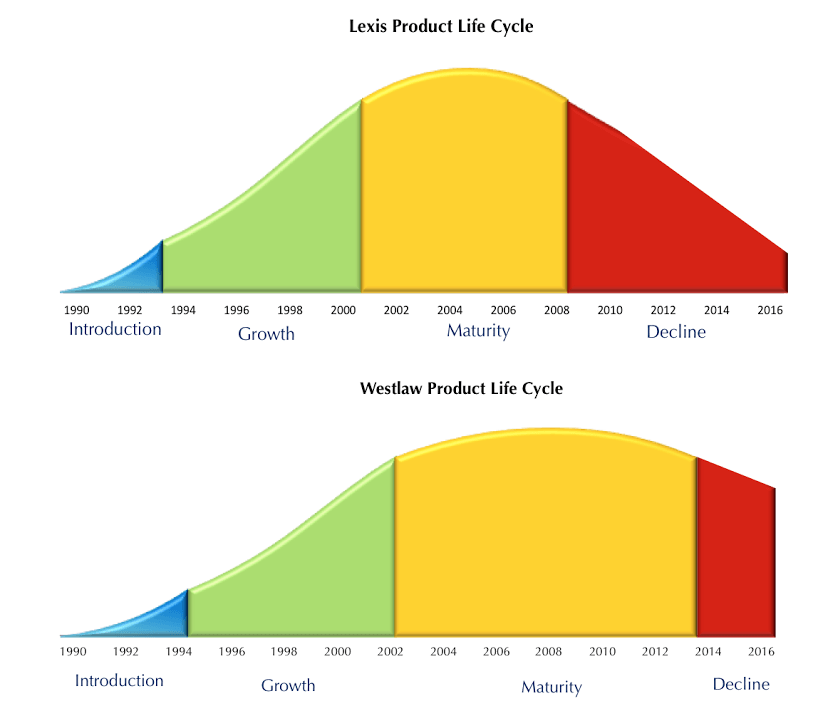

Stick with Westlaw and/or Lexis long enough, and chances are you’ll be getting among the worst value.

In legal information the best deals and offers are reserved for new customers. And who’s funding those great deals? Loyal customers like you.

The new customer is their preferred customer. Loyal customers just pay for it.