The Demise of the Wexis Monopoly

By Michael Feit | Sole Provider , Vendors

Today, over 50% of large law firms retain only Lexis or only Westlaw. Within large law, 21% of firms with over 500 attorneys have gone this route. If a firm with 1000+ attorneys can go sole-provider, does this foretell the end of the Wexis monopoly?

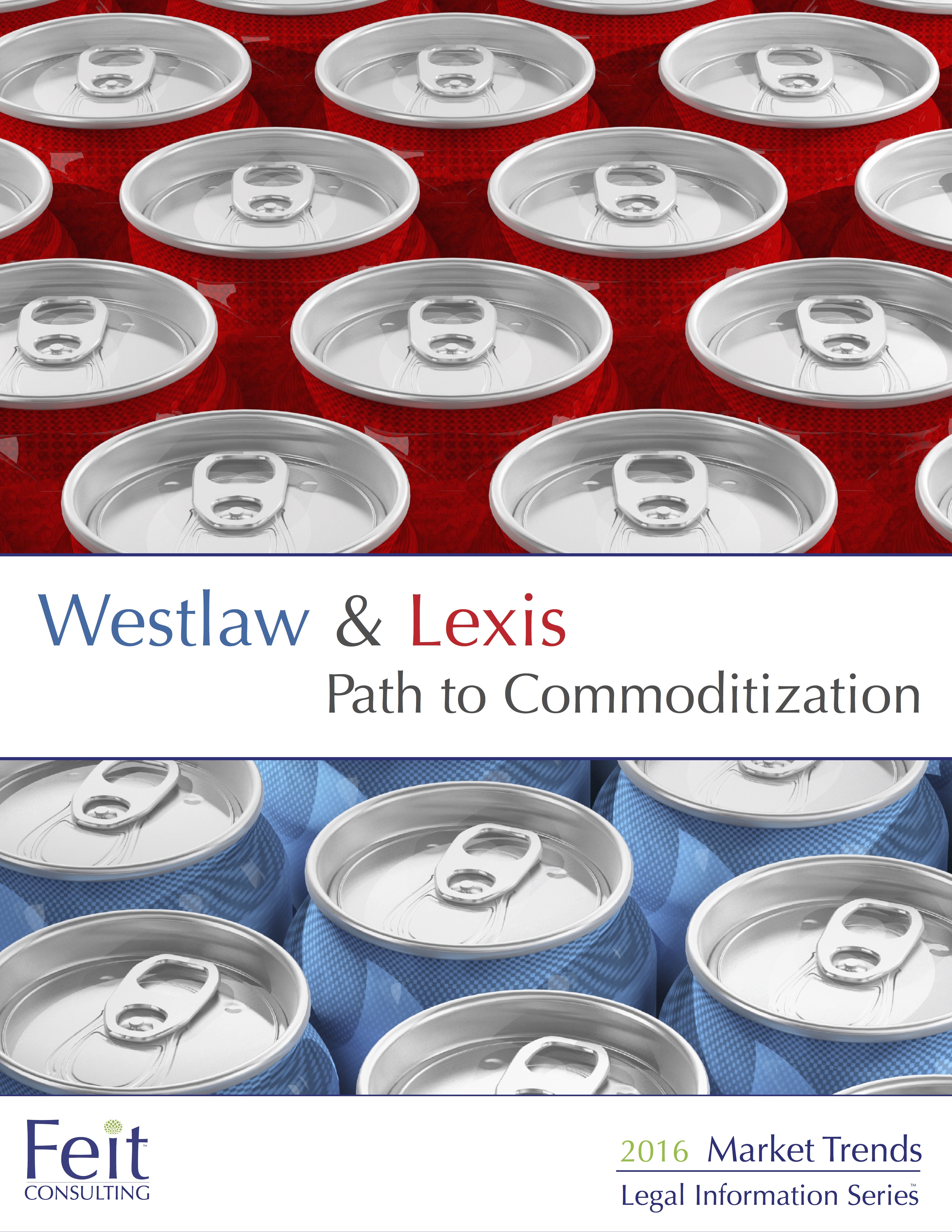

In the world of legal information, Westlaw and Lexis have been and remain the market leaders. Until recently, midsize and large law firms universally believed that Westlaw and Lexis were complementary products. Even once-innovative products and services ultimately find themselves on the path to commoditization as they mature. Fierce competition motivates products to adopt their rival’s successful features, and therefore become more similar. While there may be preference for one or another, unique product benefits become less obvious.

As corporate clients pushed back on research costs, firms were not able to recover costs entirely. The effect on the bottom line pushed some firms to make the decision to go sole-provider. The freedom of funds allows firms and organizations to purchase wish-list software and technology to enhance the delivery of legal information. Feit Consulting has been monitoring the sole-provider trend for over a decade. While this has worked for some, the big question is whether it is the right decision for your firm or organization.

How should you proceed?

1) Get the pricing intel to determine contract pricing is favorable. Compare contracts with market intel in Feit’s white paper, Optimizing Legal Information Pricing.

2) Whether or not your firm or organization has favorable pricing, this alone does not pre-determine whether you should keep both. It is worthwhile to assess the viability of sole-provider option. Develop a business case. If needed, check out this resource, the Sole-Provider Viability Decision Guide.

3) Execute and implement. Consider hiring a consultant if you decide to make a change.

Regardless of the outcome, exploring the sole-provider option is a healthy step in revising your legal-information strategy and can provide intelligence to enhance your tactics for upcoming negotiation. If you choose to do it alone, these resources are an advantage to legal-information decision makers on what steps and considerations should be made in the process.