One would think that customer sentiment and pricing would be like a dot-to-dot exercise with a straight line easily drawn from high levels of satisfaction to steady, if not incremental, year-over-year price increases. Instead, other factors like hitting the price ceiling and reaching critical mass with ancillary products also influences forecasted pricing.

This disconnect is what we found as a result of our analysis central to Feit Consulting’s 2019 Legal Information Pricing book. When juxtaposing customer sentiment with the pricing forecast analysis, there are some striking discontinuities which at first glance, may seem even contradictory.

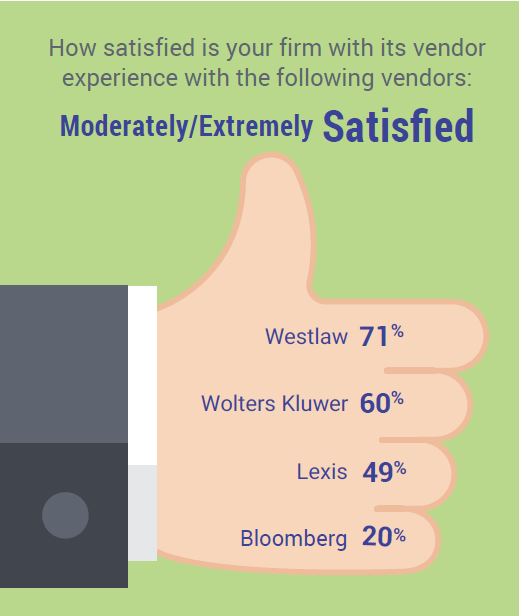

The market, for instance, has a very favorable opinion of Westlaw; in fact, the most favorable opinion of any provider.

However, our pricing forecast went on to show Westlaw as the only product covered in 2019 Legal Information Pricing whose price will decline over the next five years. How could this be?

Ironically, Westlaw’s consistent strong performance in comparison to Lexis, makes it extremely vulnerable. Currently at nearly double Lexis pricing, the report fleshes out the unsustainability of this price gap. In short, Westlaw–and the market–may have found its pricing ceiling.

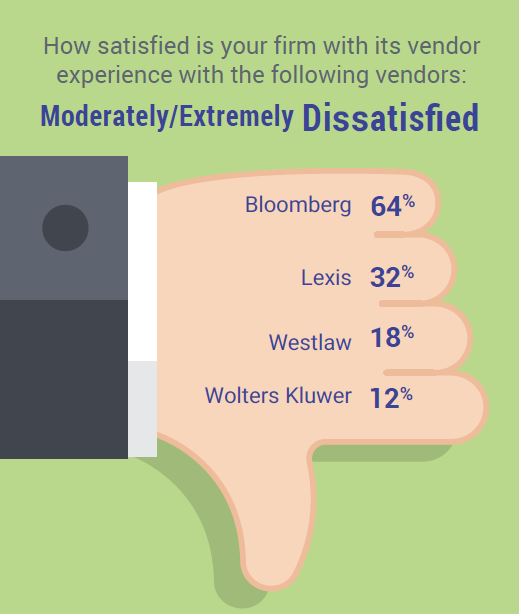

Flipping the sentiment, on the other end of the scale, 32% of respondents were extremely or moderately dissatisfied with Lexis. However, this did not correspond with linear drop in price as Lexis now offers an array of products that most firms consider indispensable. Lexis may have reached a ‘critical mass’ with well-used ancillary products that are creating different outcomes than expected.

In terms of sentiment, Bloomberg is by far the biggest loser with 64% dissatisfaction. However, our guidance indicates price growth for Bloomberg as they have important content. In addition, the market now expects aggressive price increases. As Bloomberg improves, we expect its pricing to stay competitive with Lexis and move toward Westlaw over the next five years. If you believe Bloomberg’s hype, its product will improve each year substantially and unlike with Westlaw and Lexis, and firms will not have to purchase add-ons as the product improves.

A comprehensive discussion is outlined in 2019 Legal Information Pricing.

Michael Feit earned his J.D. from the Loyola University School of Law in Chicago and was an executive at Westlaw before founding Feit Consulting 16 years ago. Feit Consulting partners with law firm administrators and legal information professionals to optimize vendor contracts and the management and delivery of legal information resources by providing leading-edge, customized solutions. Contact Michael at mike@feitconsulting.com