The End of Books is Here—What Are the Steps to Take Now?

By Alex West | Feit Consulting

By Alex West l Feit Consulting

COVID-19 has transformed the law firm market. One of those significant, industry-wide changes is how COVID has essentially put an end to books. The good news is, placing focus now on the diminishing value of print creates a valuable opportunity for your firm.

Non-digital assets which cannot be accessed remotely have been rendered useless. Even for in-office professionals, librarians are faced with challenges, such as potential new costs and disruption to sanitize shared objects such as books.

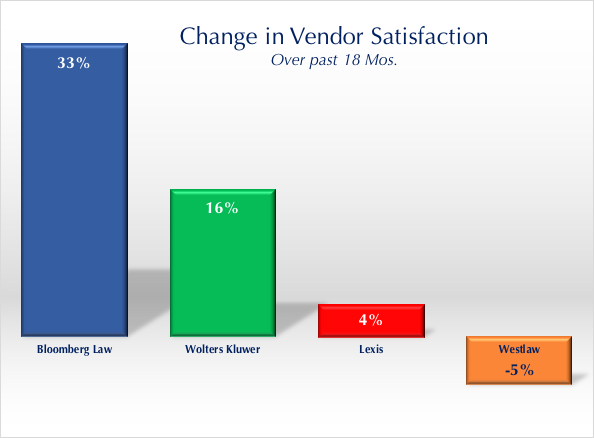

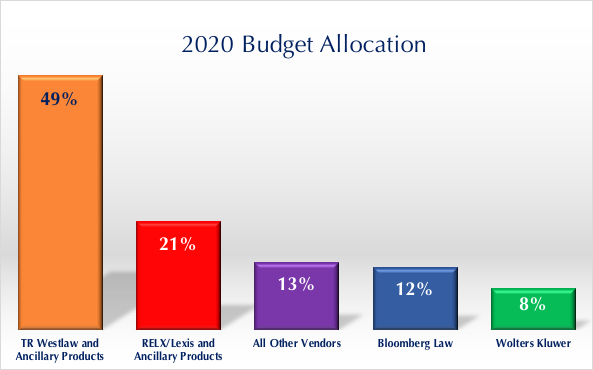

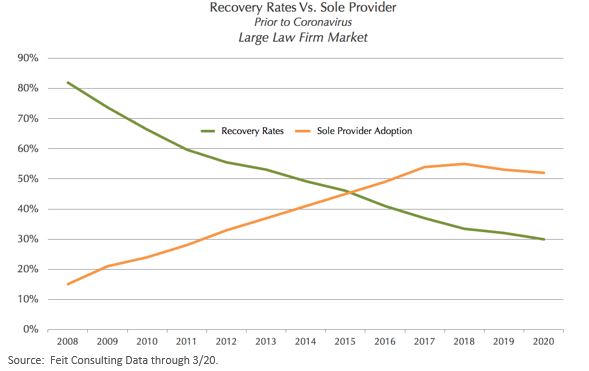

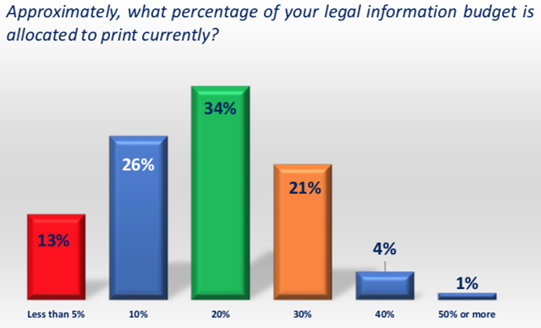

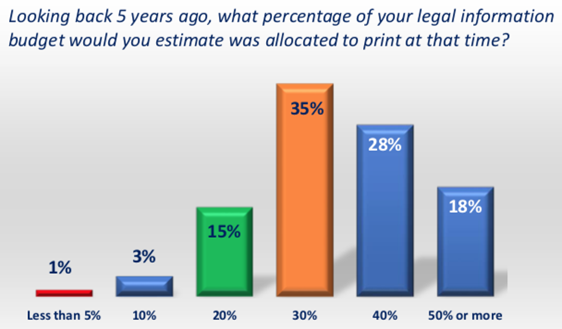

We’re seeing the data tell the story in our recent legal information market survey.

We asked respondents how much print made up the budget prior to COVID and what will happen after COVID. We were surprised by the enduring legacy of print. On average, print made up 18% of the current total legal information budget, down from 30% over the past 5 years.

Then, we asked respondents how their print collection budget has changed over time. We noted a significant decline in print, but we were once again surprised by print’s enduring legacy as shown below:

- 1/3rd of our respondents said that 20% of their current budget is for print products.

- 5 years ago, that same third of the market was spending 30% of its budget for print.

Finally, we asked respondents about their plans for print collections post-COVID, over 90% said they are getting rid of all print whenever possible.

90% is huge. Many of those surveyed noted that savings won’t be achieved in the first year due to print contracts and print retention clauses. Foreseeing the end, the vendors with a large legacy investment in print, have slowed law firm cancellations of print, by creating obstacles to elimination:

- Lexis utilizes print and off-line retention clauses to effectively handcuff firms, penalizing them for canceling print.

- Westlaw’s LMA, probably the most successful cancellation inhibitor gave firms a substantial discount to keep print and provide ‘price protection’ (against Westlaw’s own price increases).

- Firms without LMA’s saw their print costs rising >11% annually.

Our survey showed 57% of firms still had LMA’s with Westlaw, indicating that many firms have substantial print and will have to wait to receive savings due to their contractual obligation to pay for print for a certain period of time.

The expiration date for print is now. Getting rid of something as ingrained as print can be difficult – especially during stressful times. But doing this exercise now is important. What are the next steps?

- Collection Review

- Roadmap to a Future without Print

Feit’s library team is ready to help. There are tremendous cost efficiencies available to firms that make this transition effectively. If you’d like to learn more about how Feit is helping its clients, click here to set up a meeting.

About the Author

Alex West, M.B.A., Senior Vice PresidentAs Senior Vice President, Alex guides client interaction and strategic direction for the Advising group at Feit Consulting. With an extensive corporate background in management and marketing at Fortune 500 companies such as Sara Lee, Hasbro and P&G, Alex oversees all Feit client engagements. With Feit Consulting’s analytics and deep knowledge base in the legal information market, Alex optimizes customer experiences with strategies tailored to each Firm’s individual needs.