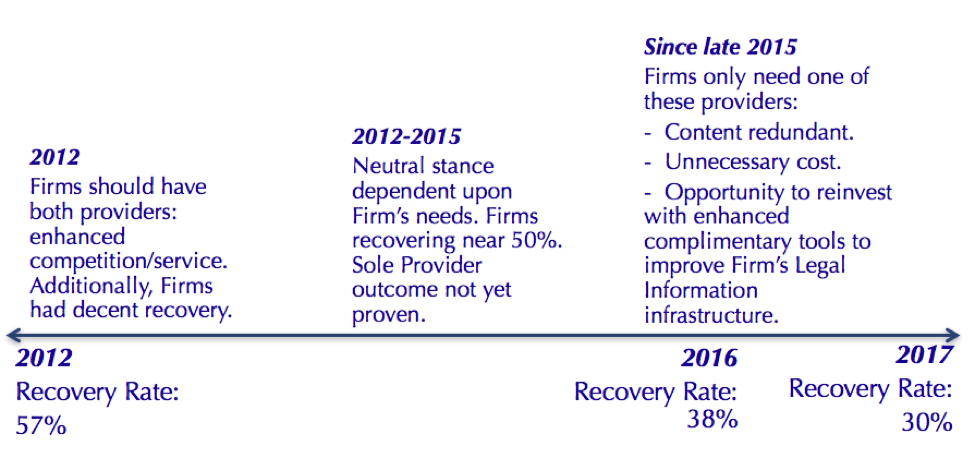

Vigorous debate continues regarding the viability of a large law firm successfully operating with just Lexis or just Westlaw. However, for the first time since the early 1990’s, retaining just one of these vendors has become the norm. Today, nearly 51% of large law firms have opted to retain only one vendor.

An evaluation of the sole-provider option has become necessary for law firm administrators. Whether or not a firm chooses to go sole-provider, the evaluation in itself provides an opportunity for a firm to review, revise and refine its legal information strategy and potentially save significant money.

In a perfect world, Lexis and Westlaw would publish retail pricing, and firms could pick and choose which products they wanted based on their practice needs and budget. This ideal world does not exist today, as both vendors have discontinued standardized pay-as-you-go retail pricing. Instead all they offer is secret pricing and terms that vary greatly from firm to firm.

The idea of transitioning to sole-provider can be daunting, considering the many individuals and processes that might be impacted. There are a great number of elements to examine, from contracts to content, not to mention the strong reactions of users to fundamental system changes. Lexis and Westlaw have both successfully infiltrated law firms’ cultures and infrastructures over their many years of service.

Yet, the pay-off in taking a deep look at these factors can be exceptional. A midsize U.S. law firm with favorable pricing will spend well over half a million dollars annually to retain both vendors. There was a time not long ago when firms could pass through online legal information costs to clients, making Lexis and Westlaw essentially free. That is no longer the norm. We have entered a new paradigm.

This is what inspired us to write the Sole Provider Playbook. It is intended to empower you and your firm to break free from the vendors’ shackles. In a world where every law firm is searching for efficiencies, the Playbook presents a clear path to savings. Our team of experts has carefully examined each step of the process, and we aim to provide a range of solutions to any obstacle whenever possible. Meant to be an all-encompassing guide, Playbook will provide your firm with tools to quickly determine the viability of the sole-provider option and how to actually execute it.

Order your copy today!