By

Michael Feit

|

Feit Consulting

In July, Westlaw launched its AI-technology powered, predictive legal search tool Westlaw Edge.

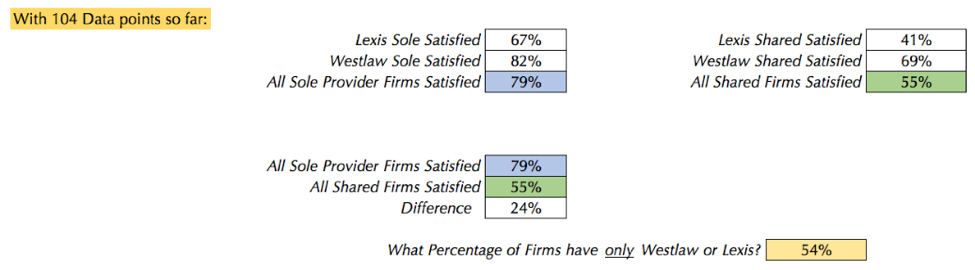

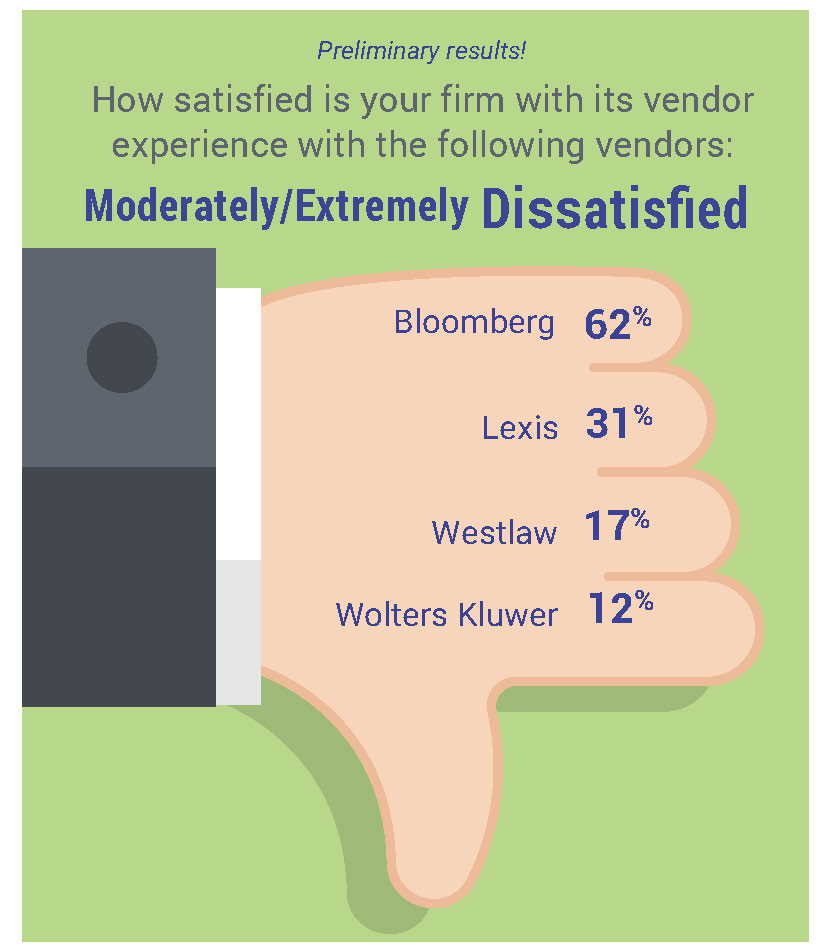

Westlaw has long been considered the leader in comprehensive legal information services, providing a comprehensive package of services at premium prices. Early results of our annual market survey show a continued high level of satisfaction with Westlaw:

However, despite their popularity, the survey also shows that many firms are going to postpone consideration or adoption of Westlaw Edge until the pricing falls. To date, less than 20% of firms who have responded have noted that they intend to go forward with Westlaw Edge in the next 12 months.

Compounding the situation, Westlaw Edge is entering the market at nearly the same time that LexisNexis and Bloomberg BNA, are competing with their own enhanced AI products, with similar technologically advanced features. In the case of Lexis, their pricing tends to be much lower than that offered by Westlaw, and as a result Lexis is likely to be more palatable.

When competing products include many of the same analytical features, pricing becomes more important. Westlaw is fine with only 20% of customers purchasing Edge at the high, introductory price as it stands to see a considerable increase in revenue due to this. Westlaw is risking that firms will try the AI alternatives at a lower price and Westlaw will lose future business altogether.

As law firms are experiencing long term downward pressure on price, the Edge pricing strategy is out of synch. There are myriad stories of market dominant companies that don’t heed the call of price sensitivity or shifts in the market place – Sears, Blockbuster, Blackberry, remember Kodak? To regain market share, Westlaw’s competitors–principally LexisNexis–have made adjustments, not only to their prices, but also to their product offerings.

Due to Westlaw’s tremendous product loyalty, prices have grown to a point where their customer’s are being forced to try alternatives. Edge could help Westlaw retain its popular position if pricing was perceived to be less aggressive.

Share your thoughts on Westlaw Edge and the market! Our Survey is closing in just over a week on December 15th and all participants receive a complimentary copy of the full results. To join, start here.