Is Lexis Cool Now?

By Michael Feit | Feit Consulting

Lexis has gone through a lot of changes over the years.

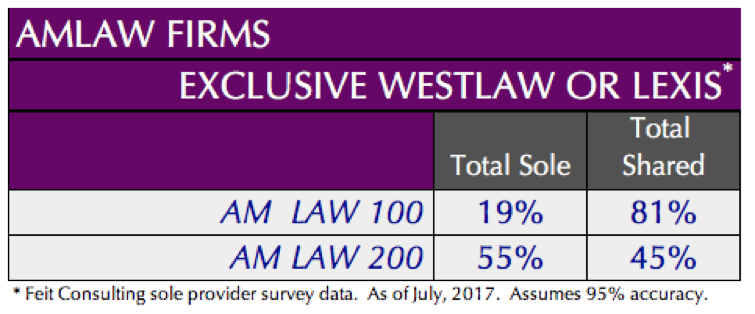

After being first to market with an online research platform–years before Westlaw–it long-ago lost is pre-eminent position. As recently as 5 years ago, the only talk of Lexis was what on earth is going on? Here at Feit we just assumed they were going to be spun off or acquired. Not really the buzz you would want in the market.

But something changed. Lexis’ parent company RELX doubled-down. They opened up their checkbook and snapped up several of the hottest Silicon Valley upstarts in the legal information space while upgrading their troubled LexisAdvance platform. Lexis spent over a billion dollars by some estimates in the process.

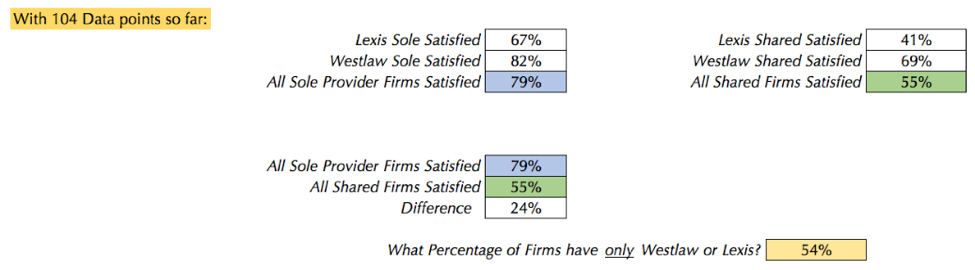

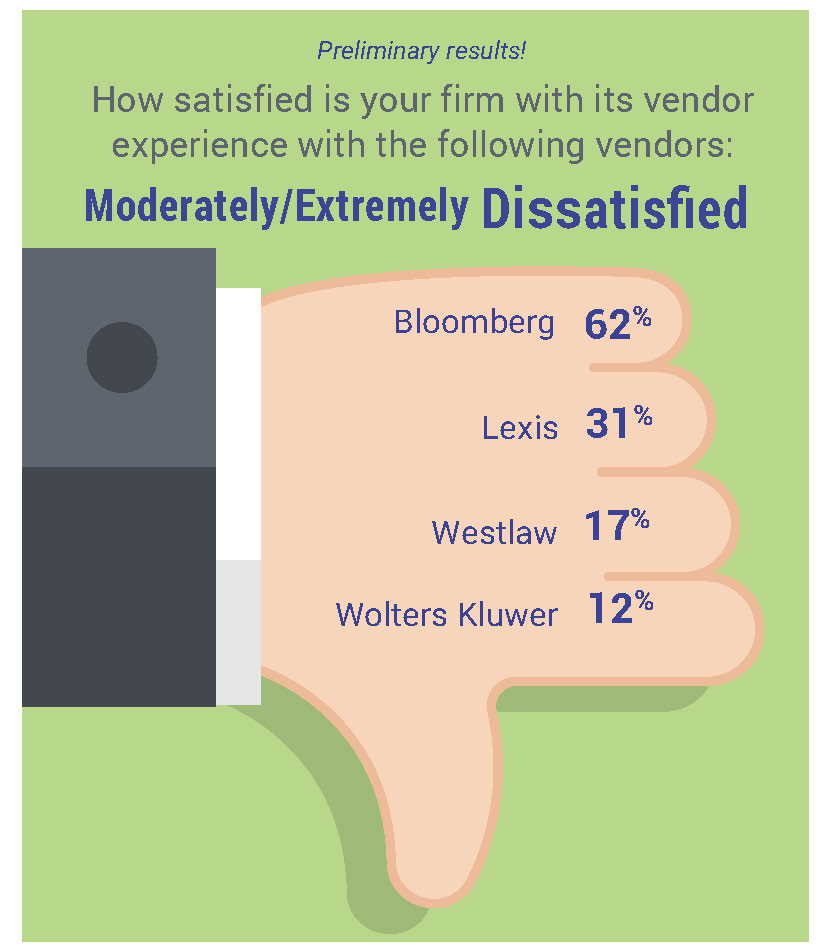

So, Lexis should be cool now, right? Unfortunately, our survey, and our clients, tell us a different story.

A very high percentage (32%) of our survey respondents were extremely or moderately dissatisfied. Additionally, there was a large volume of vocal, disgruntled comments about Lexis bundling practice. Making matters worse, our survey indicated those dissatisfied customers are planning to eliminate Lexis.

Lexis now offers products that most firms consider indispensable, but there is no harmonization of these new assets. Additionally, there is a lack of sensible pricing that resonates with customers. With these assets in place, developing customized solutions that truly meet law firm’s needs should be the easy part. Lexis needs to regain the customer love once again, and a good start would be to re-build relationships.

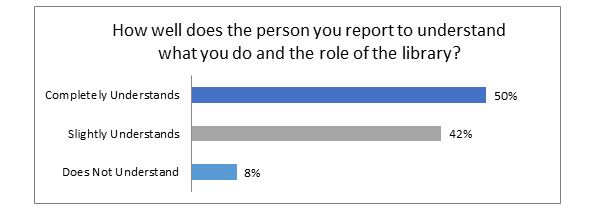

Rather than just focusing on revenue growth, critical to Lexis’ success is C-Suite leadership that builds on the needs of the law firm market. Real success is having your customers believe that Lexis’ products can improve their workflow and profitability.

To be cool, Lexis will need ultimately to deliver on integration of these new products into LexisAdvance. Lexis should focus on client development and retention, developing pricing and product programs that resonate with clients. Lexis needs to make its customers feel good again.

If ‘coolness’ is attained, we don’t know how long it can be maintained. Technology is evolving at an exceedingly rapid pace. But at least for now, however, Lexis has an aura that is semi-cool which they haven’t had for a long time. We see a great opportunity for Lexis to build on this and compete and win the coolness competition.

Michael Walsh, if you are reading this give me a call, we should talk.