By

Michael Feit

|

Feit Consulting

This article appeared in Legaltech News on 11/13/18.

By Michael Feit

mike@feitconsulting.com

This fall, law firms who subscribe to a handful of BNA reporters and electronic newsletters are receiving a surprise: renewal proposals with unexpected price increases. This comes on the heels of the discontinuance of key products these firms rely on. Early reports from law firm information professionals are describing the proposed price at a substantial 30 percent, 40 percent, or even 50 percent. To justify the upcharges, BBNA clients are being forced into unplanned upgrades with either full or limited BLAW access.

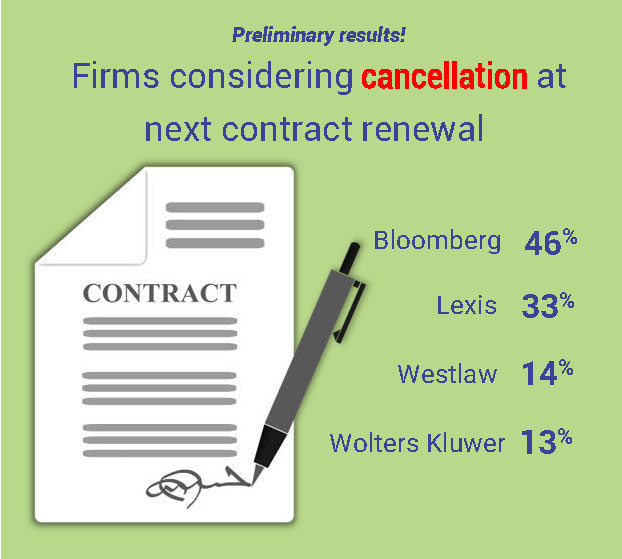

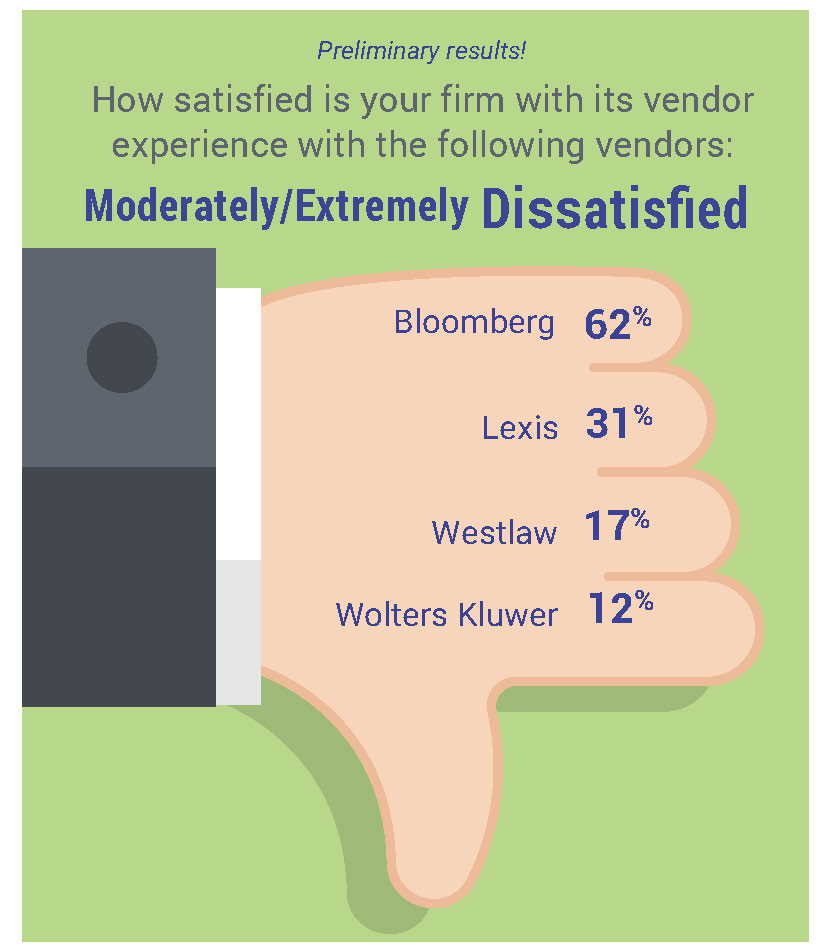

This had not been the standard for BBNA, although it is reminiscent of tactics by their competitors Westlaw and LexisNexis. Up until recently, Bloomberg had abstained from aggressive pricing negotiations. The cost per seat for Bloomberg products may have been high, but annual price increases were within standard range and the prices themselves were more or less transparent. This policy change indicates that BBNA has not been successful illustrating to firms the value of their products beyond what firms may already be receiving from Westlaw and/or LexisNexis.

At certain firms, Bloomberg has the ability to leverage the high value and regard for a small set of their content, which is now enabling them to be more aggressive in negotiations. How far can BBNA push the market and their prices before people walk away?

BBNA is also presenting firms with confusing options, bundling completely different arrays of products, pricing and terms. Firms are reporting that it is taking weeks just to understand the proposals. In addition, when the bundles are fully understood, many are realizing that none of the options actually meet the firm’s needs—and all deliver a big bump in cost. Bloomberg knows that many of these reporters are deemed essential, and this allows them to apply unprecedented pressure.

With no significant advance warning, firms have little recourse in this round of negotiations. Firms have few immediate alternatives, although they exist to a degree thanks to competitors like Wolters Kluwer. With no warning, and no time to negotiate, research or prepare, de facto options are essentially nonexistent.

From a broader perspective, as Bloomberg has had little success penetrating the firm-wide market as a competitor to Westlaw and Lexis, it seems to have decided to leverage the strengths of its unique assets. However, it is unknown if this short-term thinking will be sustainable in the long run.

In the end, the outcome may resemble what has transpired in other similar markets. Alternatives and new competitors will spring up. Customers will be on the alert to seek out more reasonably-priced options. And when the pain of these price increases—and presumably, additional increases to come—becomes too great to bear, firms will simply begin to walk away.

In the meantime, however, this rearguard pricing action is nothing more and nothing less than an information imbalance. It’s basic economics. Markets operate efficiently when everyone has a reasonable degree of information. In this case, Bloomberg currently has all the information and is leveraging that advantage (for now).

In our view, the worst response a firm could have is to default into accepting the new deal. The best response firms can have to these tactics is to increase their own information storehouse. Arming yourself with information about substitutes creates the best possible environment for negotiating, and if necessary, saying “no” is a negotiator’s best friend. This means taking steps now to determine whether the Bloomberg suite of products is absolutely essential, or whether there are alternatives to fill some (or all) of the resulting gaps.